$100k for a University Degree?

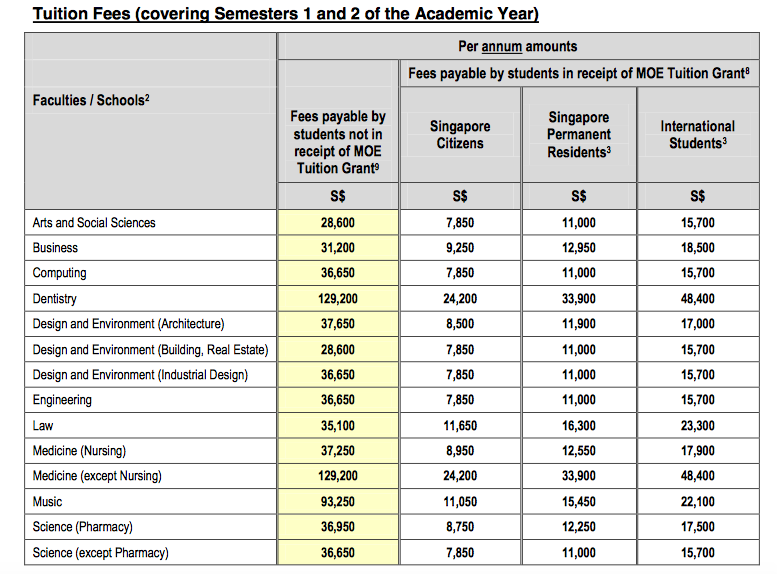

Yes you read the title correct. In time to come, our children may have to fork out over a $100,000 just to get a piece of paper that grants them an interview for an entry level job. Well, that is not the problem. The real problem is you, the parent, is going to pay for it! So how can a university degree cost so much? Let's see the following breakdown. For illustrative purposes, we shall use a NUS (National University of Singapore) Business degree for a new-born baby girl as example. Here is the current tuition fees charged by NUS: According to NUS's tuition fee schedule, a Business degree costs $9,250 per annum.