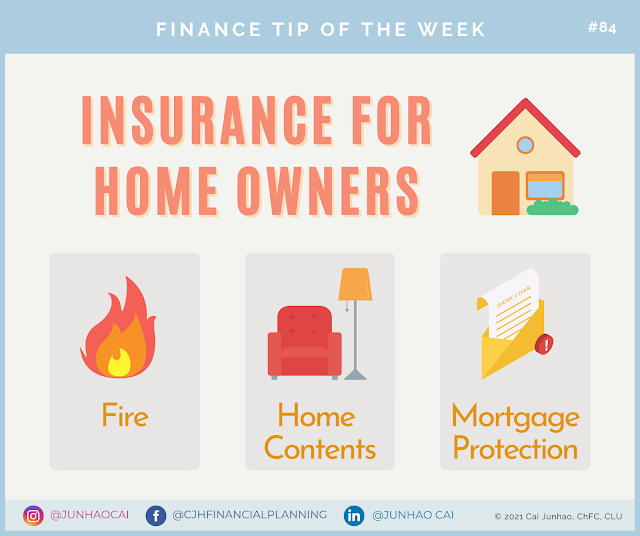

3 Insurance All Home Owners Must Consider

As a homeowner, our nest is our pride and joy. It is also where we have sunk in a lot of money as well. Therefore we must ensure that our most valuable asset is protected. Here are three types of insurance covers that all home owners must consider.

(1) Fire Insurance

Fire insurance provides coverage for damage to the building, structures, fixtures, and fittings caused by fire. This is mandatory if you have an outstanding home loan, either with HDB or with a bank.

Do note that fire insurance does not cover renovation or improvements, furniture, electrical appliances, and other home contents.

(2) Home Contents Insurance

Home contents insurance provides more comprehensive protection and can cover damage to renovations or improvements, home contents, and personal effects such as your watches, computers, or valuables - they can often cost more than the renovation itself.

Besides damage to property caused by perils, home insurance can reimburse you for loss should there be a burglary or theft.

It also covers your liability as a home owner, if you find yourself caught in an unfortunate situation whereby you are responsible for damage or injury to a third party, such as a visiting friend who slips on your wet tiles and becomes paralysed as a result.

(3) Mortgage Protection Insurance

We never truly own our home until we have cleared our loan - the bank does. This means that in the event of our death, the bank has the power to sell it to recover the amount owed. What would happen to our loved ones?

Mortgage insurance guarantees a lump sum payout if the home owner dies or becomes disabled. It is usually offered in the form of a reducing term policy, with its cover decreasing in tandem with your outstanding loan amount. Premiums are relatively affordable, and the payout can be used to fully clear your mortgage loan.

Never take the security of your home for granted. Protecting your home is also protecting the safety of your loved ones.

Comments

Post a Comment